A virtuous circle is now in place, underpinned by a significant programme of large scale infrastructure investment.

Significant Economic Growth

The last few years have seen Montenegro’s economic performance improve dramatically through the adoption of the Euro as the legal tender and significant investment in the country’s infrastructure especially tourism, energy, water and transport links.

Young, Stable Democracy with an Open Economy

Montenegro’s unspoiled natural beauty and favourable economic and political climate have allowed the small country of approximately 650,000 citizens to emerge as one of the most attractive tourist destinations in Europe. The overall economic activity has been growing strongly with the tourism industry as the major vehicle, propelling investments in other sectors of the economy, creating €3.2 billion in total planned additional investment along the Montenegrin coast.

A Business Friendly Environment

Montenegro has one of the lowest corporate and capital gains tax rates in Europe (9%), low barriers to entry for new businesses, property rights, and a price-competitive, educated young labour force. It became a full member of the World Bank, IMF and EBRD in 2007, WTO in 2012, and progress toward NATO and EU membership will further guarantee political and economic stability.

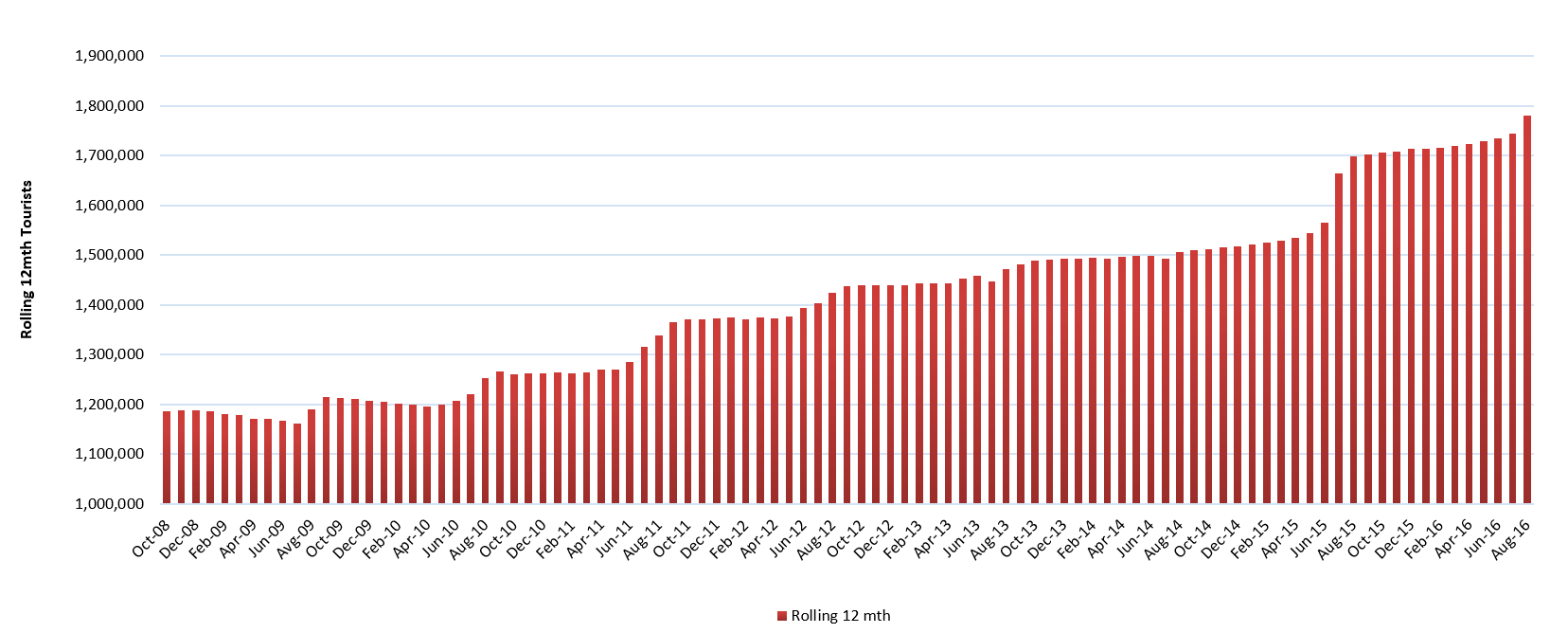

Montenegro leads the World in Tourism Growth

According to the World Travel & Tourism Council and Oxford Economics (2014), Montenegro is likely to be the fastest-growing travel and tourism economy in the world over the next decade, surpassing Brazil, Russia, India and China. Montenegro has recently experienced an upsurge in the popularity it once enjoyed in the 1960s, then a haven for the European elite and film stars such as Sophia Loren, Elizabeth Taylor and Kirk Douglas.

Investment Basics

Corporate Taxation

Nautical Taxes

Withholding Tax

Personal Taxation

Value Added Tax

Avoiding Double Taxation

Macro

Micro

*Source: Deloitte, International Tax. Montenegro Highlights 2014